Statement of owner’s equity cengage – The statement of owner’s equity, a crucial financial document, provides a comprehensive overview of a company’s financial health and performance. This guide delves into the intricacies of this statement, explaining its purpose, components, preparation, analysis, and applications in decision-making.

Understanding the statement of owner’s equity empowers business owners and stakeholders with valuable insights into their company’s financial position, enabling them to make informed decisions that drive growth and success.

Statement of Owner’s Equity: Statement Of Owner’s Equity Cengage

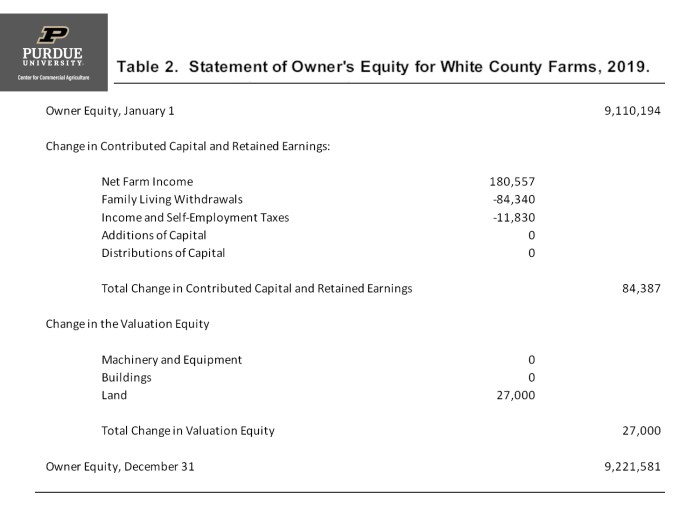

A statement of owner’s equity is a financial statement that summarizes the changes in the owner’s equity of a business over a specific period of time. It shows the initial owner’s equity, any additions or withdrawals made during the period, and the resulting ending owner’s equity.

The statement of owner’s equity is an important financial statement because it provides information about the financial health of a business. It can be used to track the progress of a business over time, identify trends, and make informed business decisions.

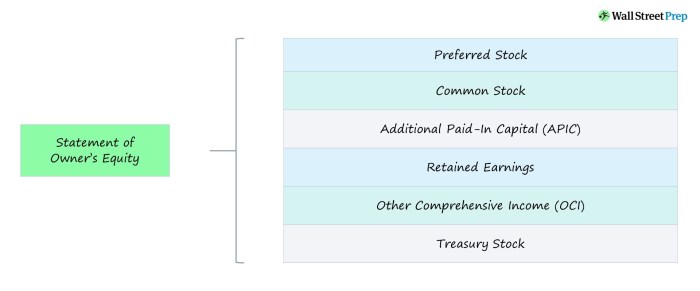

Components of a Statement of Owner’s Equity

- Beginning owner’s equity:This is the owner’s equity at the beginning of the period.

- Net income:This is the profit or loss of the business for the period.

- Withdrawals:These are the amounts of money that the owner has taken out of the business for personal use.

- Contributions:These are the amounts of money that the owner has invested in the business.

- Ending owner’s equity:This is the owner’s equity at the end of the period.

Preparation of a Statement of Owner’s Equity

The preparation of a statement of owner’s equity involves the following steps:

- Determine the beginning owner’s equity.

- Calculate the net income for the period.

- Record any withdrawals or contributions made during the period.

- Calculate the ending owner’s equity.

Analysis of a Statement of Owner’s Equity, Statement of owner’s equity cengage

The statement of owner’s equity can be analyzed using a number of ratios and metrics, including:

- Return on equity (ROE):This ratio measures the profitability of a business relative to the owner’s equity.

- Debt-to-equity ratio:This ratio measures the amount of debt that a business has relative to its owner’s equity.

- Owner’s equity ratio:This ratio measures the percentage of the business that is owned by the owner.

Use of a Statement of Owner’s Equity in Decision-Making

The statement of owner’s equity can be used to make informed business decisions, such as:

- Investment decisions:The statement of owner’s equity can be used to evaluate the financial health of a business and make investment decisions.

- Financial planning:The statement of owner’s equity can be used to plan for the future financial needs of a business.

- Dividend decisions:The statement of owner’s equity can be used to determine whether or not to pay dividends to the owner.

FAQ Section

What is the purpose of a statement of owner’s equity?

The statement of owner’s equity provides a detailed account of the changes in a company’s owner’s equity over a specific period, typically a quarter or a year.

What are the key components of a statement of owner’s equity?

The statement of owner’s equity typically includes the beginning and ending balances of owner’s equity, as well as any additions or subtractions that occurred during the period.

How is a statement of owner’s equity prepared?

The statement of owner’s equity is prepared by taking the beginning balance of owner’s equity, adding any additions that occurred during the period (such as net income or capital contributions), and subtracting any subtractions that occurred during the period (such as withdrawals or losses).

How can a statement of owner’s equity be used in decision-making?

The statement of owner’s equity can be used to make informed business decisions by providing insights into a company’s financial health, profitability, and cash flow.